Start Your Child's Financial Education Early: Tips for Teaching Your Children the Basics of Money Management

Taking steps early on to prepare your children for their financial future may keep them from ending up like many American adults are today – in debt. According to a recent Bankrate survey, only 43 percent of adults have enough money in savings to cover $1,000 in unexpected costs.

The sooner you start teaching your child about money, the better. Your child doesn’t need to know about stocks or retirement plans, but they can understand putting coins in a bank to save up for a special treat.

If you’re ready to build your child’s financial literacy at every age, incorporate these lessons into their daily activities.

Understanding the Five Principles

Financial literacy is understanding how to effectively manage money to reach your goals, make better financial decisions, and safeguard against financial troubles. There are five principles or building blocks that make up financial literacy, according to the Financial Literacy and Education Commission. These principles can help you make day-to-day financial decisions and plan your goals.

As your child grows, make sure they learn these five foundational rules:

- Earn: Learn more about what you're making in money.

- Save and interest: Teach the importance of budgeting or tracking your money.

- Protect: Learn the steps to create an emergency fund of about three to six months in reserves.

- Spend: Watch how much money you're spending.

- Borrow: Learn how to borrow money to cover unexpected expenses or bigger purchases. This teaches you how to pay bills on time and improve your credit score.

Learning Their Numbers

Learning their numbers is an important step in their development for children in preschool and kindergarten. Think about including a financial lesson in their counting.

Show your child the difference between coins and bills, how to group them, and count.

As they get older, show your child the different forms of money you use. Depending on the situation, share when and why you might use one form of money over another. Start with these four types:

- Cash: This includes paper and coin currencies.

- Checks: Explain how this piece of paper allows you to pay someone with money from your account.

- Debit cards: Explain this alternative to cash or checks.

- Credit cards: Teach your child you must pay back the money you borrow.

Make It a Game

If your children love games, try fun and interactive ways to teach money management. Teach children the concepts of financial literacy through board games. Games like Payday, Life, and Monopoly can show valuable money management skills. Your child can learn to:

- Purchase items.

- Take out loans.

- Learn to budget.

- Measure risk versus reward.

There are also interactive games and activity sheets online that teach financial literacy to children. For instance, the U.S. Mint Coin Classroom allows children to play games and watch videos, as well as learn about the life of a coin and download coloring pages.

If your child is into football, Visa® and the National Football League teamed up to teach financial concepts with Financial Football, an interactive game that educates youth about finances using this beloved sport. Choose your favorite football team but instead of throwing the ball, you must answer financial questions to earn yardage and score touchdowns.

As your child gets older, videos games such as Animal Crossing or Minecraft can teach crucial money skills and critical thinking. They can also teach your child how to budget. Some of these games introduce real-life elements they can learn as they play. For instance, in Animal Crossing, there are opportunities to learn about a mortgage, savings accounts, and more.

Put Them to Work

The best way for your child to learn the value of a dollar is by earning it themselves. Getting an allowance for age-appropriate tasks will help them understand earning money takes hard work, focus, and dedication. Your child could:

- Do chores around the house.

- Mow the lawn.

- Take out the garbage.

- Feed the pets.

- Wash the dishes.

- Babysit younger siblings or neighbors' kids.

- Wash the car.

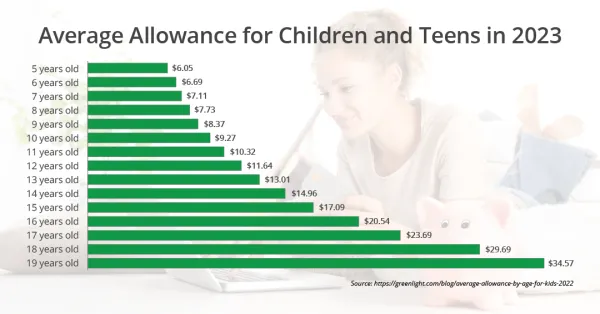

An allowance teaches budgeting skills. Family-oriented apps like BusyKid and Greenlight allow you to move funds directly into their account after they complete a task.

Keep Communication Lines Open

Money matters and financial literacy are complicated subjects. The more you talk about money, budgets, finances, savings, and investing, the more your child will want to talk about it. They'll understand the topic of finances isn't off limits and that it's OK to ask for help when they don't understand how to handle money.

Having age-appropriate money conversations with your young one early on will create an open environment for learning and asking questions about finances.

Advise Them on Financial Responsibility As They Age

Saving money is great, but your teen is going to want to spend. One way most people spend money is with a credit card. Credit cards can be a lifeline in an emergency, but they can also be a source of surprising financial pitfalls.

If you're planning to give a credit card to your child for college, teach them how to handle it. Teenagers must learn how to use credit cards wisely by:

- Paying off the balance on time.

- Avoid buying items they can't pay off.

- Understanding the difference between interest on a savings account versus the interest on a credit card.

You will help your child grow into a smart money manager with continuing conversations and attention to your child’s finances.

Open a Children's Savings Today

Take the first step in your child’s financial future and open an Adirondack Bank Children's Savings Account for your child! This interest-bearing account makes it easy for parents to teach children good savings habits. The account requires a $10 minimum balance and includes eStatements, online banking, and more.

Stop by any branch to open an account or for more details. Our dedicated staff is ready to help you choose the products and services that are right for you.

The information in this article was obtained from various sources not associated with Adirondack Bank. While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. Adirondack Bank is not responsible for, and does not endorse or approve, either implicitly or explicitly, the information provided or the content of any third-party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. Adirondack Bank makes no guarantees of results from use of this information.